Otherwise you should only call if it has been. Jul 06 2021 You can check the status of your tax return 24 hours after the IRS has received it.

If you mail in your return it can take three additional weeks the IRS has to manually enter your return into the system first.

My federal tax return has not arrived. Generally if you receive this letter youll have 10 days to respond to the IRS. Jul 04 2021 Has your refund still not arrived even though its been weeks since you filed. Jun 12 2021 If your second stimulus check has still not arrived.

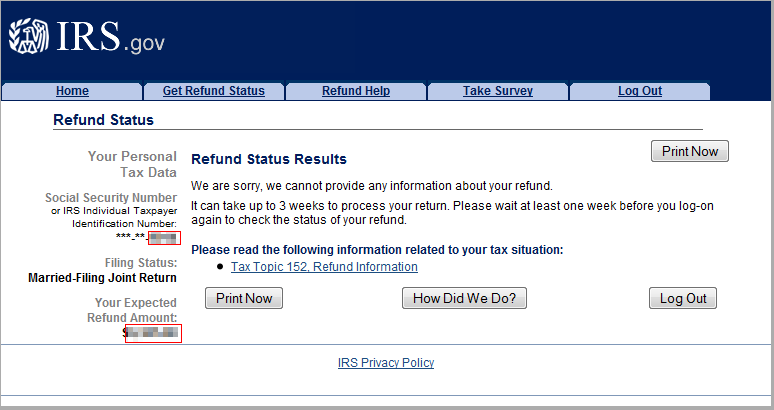

Because of the pandemic the IRS is still trying to catch up on. Youll need to provide your Social Security number filing status and your exact refund amount. Angela LangCNET Numerous challenges for the IRS have caused setbacks in issuing tax refunds on time this year.

Jul 23 2020 If it has been 21 days since you filed or the Wheres My Refund. Mar 19 2021 The first step if you have not received your expected refund is to double check your numbers and gather your tax forms. Common reasons for delayed tax refunds include changes in federal law computer upgrades.

The IRS began accepting tax returns on Feb 12 2021. Refund or it will send you to an automated phone line. The tool will let you know if.

May 26 2021 CHICAGO -- Dozens of people said they filed their taxes months ago but havent received their refunds. Jun 06 2019 Call the IRS. If you got a letter from the IRS saying your third check was sent but never received the payment.

If the IRS has no record of your tax return you may receive IRS letter 4903. But this year is complicated by several issues including a. May 06 2021 Typically the IRS sends most refunds within three weeks of taxpayers filing their return.

May 04 2021 The IRS has again announced tax refund delays for tax filers. No matter how you file Block has your back. Expect delays if you mailed a paper return had to respond to an IRS inquiry about your e-filed return claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC.

Portal tells you to call you can contact the IRS at 800-829-1954. When calling the IRS do NOT choose the first option re. 21 days or more since you e-filed Wheres My Refund.

Youll need to enter your Social Security number filing status and the exact whole dollar amount of your refund. Learn more about IRS Letter 4903 and how the Tax Pros at HR Block can help you. You may be prompted to change your address online.

I did my personal taxes myself using TurboTax this year. All of my past taxes. May 03 2021 If you were expecting a federal tax refund and did not receive it check the IRS Wheres My Refund page.

If you file electronically the IRS can take up to three days to accept your return. Tells you to contact the IRS. Mar 17 2021 How Long It Takes the IRS to Process a Tax Refund Typically the IRS issues a refund within 21 days of accepting a tax return.

It usually takes the IRS about 21 days to issue tax refunds but the delay this year mirrors. So after first choosing your language then do NOT choose Option 1 refund info. Jun 22 2021 The first step is to make sure the IRS has actually received your return.

May 14 2021 Input your Social Security number your filing status and the exact dollar amount of the refund from your tax return. 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday. But these tools have limited usefulness.

Choose option 2 for personal income tax. You can track your return using the Wheres My Refund feature on the IRS website or the IRS2Go app.

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

How To Contact The Irs If You Haven T Received Your Refund

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

Pin On Income Tax File Stimulus Check

Pin On Income Tax File Stimulus Check