Individual Income Tax Return can take up to 16 weeks to process once we receive it. Feb 18 2021 The IRS says it usually processes amended tax returns within eight to 12 weeks of the mailing date though it could take up to 16 weeks or longer particularly in cases of identity fraud.

Irs E File Refund Cycle Chart For 2021 Where S My Refund

Irs E File Refund Cycle Chart For 2021 Where S My Refund

Calling us will not speed up the processing time of your amended return.

Irs amended return timeline. If you cant meet the tax filing deadline you can file for an extension. Mar 18 2021 The deadline to submit your 2020 tax return and pay your tax bill is currently April 15 2020 though that may change like it did last year to give people more time to file during the Coronavirus pandemic. How to find my.

Most people receive their refund in an average of 10-14 days. Will calling the IRS help me get my amended return processed any faster. IRS received the amended return on April 3 2020 and on 725 the status updated to Weve received your amended return but it has not been processed please call I kind of understand that the IRS is resetting these 16 week timeframes on August 1st taking the full expected processing time into November.

Apr 29 2021 Generally for a credit or refund you must file Form 1040-X within 3 years after the date you timely filed your original return or within 2 years after the date you paid the tax whichever is later. Three years from the time you filed your original return. May 03 2021 A Form 1040-X Amended US.

An adjustment may result in a refund balances due or no tax change. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Individual Income Tax Return for this year and up to three prior years.

Receiving your amended tax returns back takes a long time. The lagging timeline is related to the passage of a. Thereafter you can get your amended tax refund after 16 weeks.

Jun 04 2021 Check the status of your Form 1040-X Amended US. Jan 05 2021 You still need to print and mail the forms. Status when checking the Wheres my Amended Return tool.

Jun 14 2017 After filing your original return and should you need to file an amended return you must usually file an amended return by the later of these dates. You can use the Wheres My Amended Return tool which is updated every 24 hours or call 1-866-464-2050 to check the status. According to the IRS website it may take up to three weeks for the document to appear in their system.

In general if a refund is expected on an amended return taxpayers must file the return within three years of the due date of the original return or within two years after the date they paid the tax whichever is later. Why did they do that. If you filed your 2019 return before the July 15 deadline the IRS is using the July deadline as the filing date for amendment purposes for example if you filed your 2019 return in February of 2020.

Your amended return will take up to 3 weeks after you mailed it to show up on our system. The processing of your amended return is not finished until you receive a complete. Jan 09 2021 Approximately 90 of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS.

May 14 2021 IR-2021-111 May 14 2021. When you file a Form 1040X or Amended Tax Return you must mail it in for processing. The IRS identified over 10 million taxpayers who filed their tax returns prior to the American Rescue Plan of 2021 becoming law in March and is reviewing those tax returns.

Jun 13 2019 If you amended return has an adjusted status this means The processing of your Form 1040X- Amended Tax Return resulted in an adjustment to your account. Processing it can take up to 16 weeks. You cant e-file your tax return.

As of March the agency still had a backlog of 24 million paper returns from the 2019. May 25 2019 The IRS will accept an amended return up to 3 years after the date you filed the original return or within 2 years after you paid the tax due on the return whichever is later. May 20 2021 The IRS backlog of 2019 tax returns keeps shrinking --- but now for the bad news.

GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY. An original return filed before the due date without regard to extensions is considered filed on the. Usually it takes about 3 weeks from the date you mailed the amended return for it to show up in the IRS system.

You bank will usually make your payment available within 1-3 days of receiving the payment from the IRS. May 17 2021 Paper tax returns filed for the 2019 tax year were stored in trailers until IRS employees could get to them. Tax Topic 308 Amended Returns.

Allow the IRS up to 16 weeks to process the amended return. Two years from the date you paid the taxes on your return. There is a statute of limitations on refunds being claimed on amended returns.

WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income.

Amended Return Status Where S My Amended Tax Return

Amended Return Status Where S My Amended Tax Return

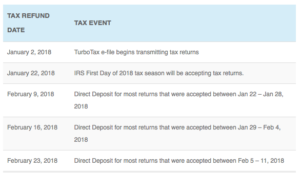

Average Irs And State Tax Refund And Processing Times Updated For 2020 2021 Tax Season Aving To Invest

Average Irs And State Tax Refund And Processing Times Updated For 2020 2021 Tax Season Aving To Invest

How To Amend An Incorrect Tax Return You Already Filed