Jun 04 2021 The amended return tool cant access certain amended returns. Attach copy of federal.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Nov 21 2018 If you discover a mistake or omission on your tax return you can file an amended return by mail.

Irs amended return attachments. If you preparing a 2014 or earlier amended return complete the Oregon Amended Schedule and attach it to your tax amendment. IRS telephone assistors dont have any additional information about your amended return while it is processing. Any forms or schedules that were added or changed as a result of preparing the amendment.

Back when it was only accepted via paper-filing the IRS wouldnt accept just the 1040-X form they wanted the whole as amended return. Mar 11 2021 If you are a resident complete Form 40. Therefore Id presume IRS and Lacerte would have set it up to e-file the whole thing.

For nonresidents use Form 40N. Feb 10 2021 For example in Tax Year 2018 Form 5471 Schedule E and H could be attached to a tax return only as PDF documents. Attach a complete copy of your federal amended return if applicable.

Please see IR-2020-107 and IR-2020-182 for additional information. Jun 01 2021 Check with your tax preparer or software provider to see if you can file your amended return electronically. Refer to our frequently asked questions for more information.

Information about Form 1040-X Amended US. Jan 22 2007 The Form 1040X Amended US. If you need to file by paper file a new 2020 SC1040 and check the Amended Return box.

Oct 14 2020 To avoid delays file Form 1040-X only after youve filed your original return. Change or filing federal amended return. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically.

Attach any paperwork including tax forms supporting your changes but dont include your old return or unnecessary documents. Generally for a credit or refund you must file Form 1040-X within 3 years after the date you timely filed your original return or within 2 years after the date you paid the tax whichever is later. You will also file an IRS Tax Amendment Form 1040X.

If you are. Generally for a tax refund this form must be filed within 3 years after the date that the original version was filed or within 2 years after the date that the tax was paid whichever is later. Individual Tax Return is used to make corrections to Form 1040 Form 1040A and Form 1040EZ tax returns that have been previously filed.

You still have the option to submit a paper version of the Form 1040-X and should. May 25 2021 Check with your tax preparer or software provider to see if you can file your amended return electronically. File Form 2555 2555-EZ or 4563.

Complete the return as it should have been filed including all schedules and attachments plus an Amended Return Schedule Sch. Form 5471 Schedule E would be attached and named Form5471ScheduleE for Tax Year 2018. Dec 10 2020 I think you can count on the whole amended 1040 being e-filed with the 1040X form.

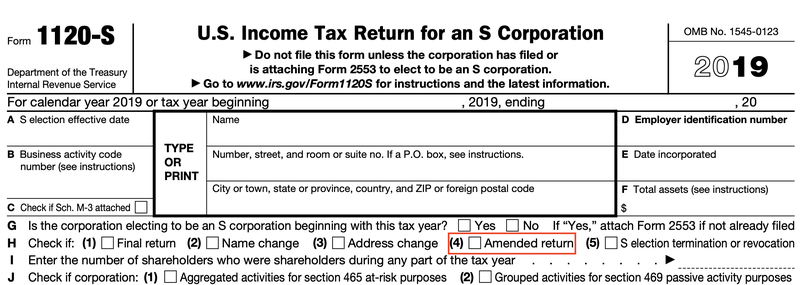

Jun 08 2019 When you have prepared your amended return and are ready to mail Form 1040-X you should include the following forms. A foreign country US. For Form 1120S or Form 1120-F Attach to the amended Form 1120S1120-F the XML document AmendedReturnChanges that identifies the line number of each amended item description the amount on the previous return the amount on the amended return and an explanation of the reasons for each change.

May 03 2021 Both the electronic Form 1040 and 1040-SR Amended Returns with attached Form 1040-X will require submission of ALL necessary forms and schedules as if it were the Original 1040 or 1040-SR submission even though some forms may have no adjustments. Internal Revenue Service Center. For more information see the instructions for the individual income tax return you need to amend.

The new amended Form 1040. Complete the return as it should have been filed including all schedules and attachments plus an Amended Return Schedule Sch. You can now submit the Form 1040-X Amended US.

Form 1040X is used by individual taxpayers to amend prior year tax returns. Call our toll-free number only when the tool asks you to contact us. You dont need to attach.

Form 5471 Schedule E and H were part of the Form 5471 Schema prior to Tax Year 2018. Allow the IRS up to 16 weeks to process the amended return. Austin TX 73301-0215 USA.

Attach IRS notification of changes or federal Form 1120X. If you are a part-year resident use Form 40P. 12-226 Form CT-1120X Instructions Amended Corporation Business Tax Return Delaware File amended return within 90 days after final determination of federal adjustment or filing amended federal return.

Use Form 1040X and follow the 1040X instructions to update your return. The amended 1040 as a. Individual Income Tax Return including recent updates related forms and instructions on how to file.

Department of the Treasury. If your amended return results in additional tax due interest must be paid on the tax you owe from the due date on the original return to the date filed or postmarked. You will need to wait until your original tax return is processed by the IRS before filing an amended return.

Send Form 1040X and attachments to. Territory or use an APO or FPO address or. Use Form 1040-X to file an amended tax return.

Individual Income Tax Return electronically using available tax software products. If you need to file by paper file a new 2020 SC1040 and check the Amended Return box.

Form 1040 X Now Can Be E Filed But Just For Now To Correct 2019 Return Mistakes Don T Mess With Taxes

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png) Form 1040 U S Individual Tax Return Definition

Form 1040 U S Individual Tax Return Definition